Yearly income tax calculator

You need not file an ITR if your yearly income is below Rs25 lakh but you. Rhode Island is ranked 7th of the 50 states for property taxes as a percentage of median income.

Tax Calculator For Salary Deals 57 Off Www Wtashows Com

Your average tax rate is 165 and your marginal tax rate is 297.

. Use our Income Tax Calculator to calculate taxable income online for FY 2022-23. Monthly and yearly in your payslip. Individuals can determine the total tax expenses through an online income tax calculator.

You pay 7286 at basic income tax rate 20 on the next 36430. Yearly Income After Tax. 25 of the gross total income.

Check tax slabs tax regimes and examples for easy calculation. After a few seconds you will be provided with a full breakdown of the tax you are paying. The types supported by our calculator are Auto-enrollment Personal Salary Sacrifice and Employer.

What is an Income Tax Calculator. Like the Federal Income Tax Connecticuts income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. You are generally exempt from paying income tax if.

An income tax calculator is a tool that will help calculate taxes one is liable to pay under the old and new tax regimesThe calculator uses necessary basic information like annual salary rent paid tuition fees interest on childs education loan and any other savings to calculate the tax liability of an individual. You pay no income tax on first 12570 that you make. You have a yearly gross income of 22000 or less.

This breakdown will include how much income tax you are paying state taxes. Her employer offers an HRA of Rs. 20000 per month and a yearly LTA of Rs.

No contributions on the first 9568 that you make. If you have a yearly bonus payment you can also add that to your annual salary and well include it in the calculations. For instance an increase of 100 in your salary will be taxed 2965 hence your net pay will only increase by 7035.

The Federal Tax Calculator below is updated for the 202223 tax year and is designed for online calculations including income tax with Personal allowance refundable non-refundable tax credits Federal Tax State Tax Medicare Social Security and Yearly Income Tax deductions we also have State Tax calculators available for each state. 40000 per month. Income tax calculator pakistan 2014 2015 income tax calculator pakistan 2015 2016 income tax calculator pakistan 2016 2017.

0 Income Tax Slabs. Connecticut collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Income Tax Income Tax Slabs efiling Income Tax Income Tax Return Income Tax Calculator Online Tax Payment Income Tax Refund Income Tax Refund Status Gratutity HRA Calculation How to file ITR Tax Advance.

The Earned Income Tax Credit or EITC is a refundable tax credit for lower to middle income working families that is largely based on the number of qualifying children in your household. California collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Income Tax Calculator - Individuals falling under the taxable income bracket are liable to pay a specific portion of their net annual income as tax.

Next click on the income field. Use New Zealands best income tax calculator to work out how much money you will take home after you get paid. If you have any pre-tax.

The Earned Income Tax Credit or EITC is a refundable tax credit for lower to middle income working families that is largely based on the number of qualifying children in your household. To use our Virginia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. To calculate gross annual income enter the gross hourly wage in the first field of this yearly salary calculator.

What income tax deductions could I be eligible for. If you are receiving monthly bonuses simply add them together to come up with the yearly figure. Gross income is money before taxationYou can read more about it in the gross to net calculator.

In case your monthly income does not include the HRA component you can claim tax benefits on yearly rental expenses under Section 80GG. Calculate your Tax on Salary Tax on Monthly Rent Tax on Business Income and Tax on Agriculture Income in Pakistan-Income Tax Calculator for years 2021-2022. Rates are up to date as of June 22 2021.

Rhode Islands median income is 73579 per year so the median yearly property tax paid by Rhode Island residents amounts to approximately of their yearly income. See your tax bracket marginal and average tax rates payroll tax deductions tax refunds and taxes owed. Qualified children for the EITC must be dependants under age 19 full-time dependant students under age 24 or fully disabled children of any age.

The first four fields serve as a gross annual income calculator. Using our Virginia Salary Tax Calculator. If you earn more than 2700000 per year your Income Tax deducted is calculated in two 2 parts.

If your yearly income is S22000 or more you are required to pay income tax in Singapore. As per Federal Budget 2022-2023 presented by Government of Pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2022-2023. 50000 a special monthly allowance of Rs.

To do so you can use a tax calculator. Provide the details of your gross salary monthly or yearly. The result in the fourth field will be your gross annual income.

You pay 159 in NI Class. Like the Federal Income Tax Californias income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. It also will not include any tax youve already paid through your salary or wages or any ACC earners levy you may need to pay.

Californias maximum marginal income tax rate is the 1st highest in the United States ranking directly. She stays in a rented house and pays a rent of Rs. These calculations are approximate and include the following non-refundable tax credits.

Before the deductions are made. Check the New Income Tax Slabs and Rates for 2022-23. If you make 55000 a year living in the region of California USA you will be taxed 11676That means that your net pay will be 43324 per year or 3610 per month.

After-tax income is your total income net of federal tax provincial tax and payroll tax. Use this calculator to work out your basic yearly tax for any year from 2011 to the current year. The basic personal tax amount CPPQPP QPIP and EI premiums and the Canada employment amount.

Estimate your provincial taxes with our free British Columbia income tax calculator. You pay 3549 in contributions at 9 on the next 39432 that you make. Your average tax rate is 212 and your marginal tax rate is 396This marginal tax rate means that your immediate additional income will be taxed at this rate.

13 of the gross amount needs to be calculated as your Non-Taxable Income then the following deductions are made. The total deductions on income tax are calculated against the minimum value of the following conditions Rent payment of up to 5000 per month. The exact property tax levied depends on the county in Rhode Island the property is.

You do not earn any income in Singapore. To determine your yearly taxable income find out what your yearly income is. National insurance contributions breakdown.

Simply enter your salary or hourly wage and let our calculator do the rest. It will not include any tax credits you may be entitled to for example the independent earner tax credit IETC. Have full transparency on how much of your paycheque goes towards PAYE income tax ACC student loan and kiwi saver.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Qualified children for the EITC must be dependants under age 19 full-time dependant students under age 24 or fully disabled children of any age. Connecticuts maximum marginal income tax rate is the 1st highest in the United States.

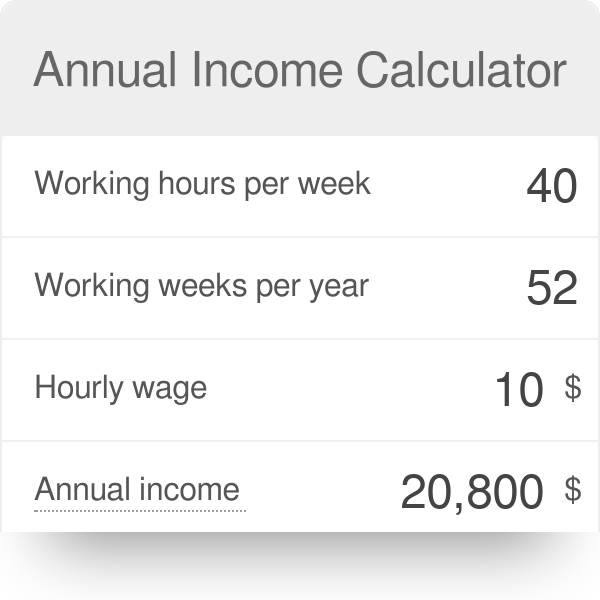

Annual Income Calculator

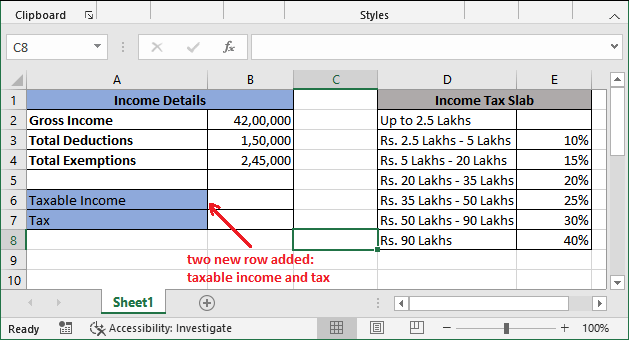

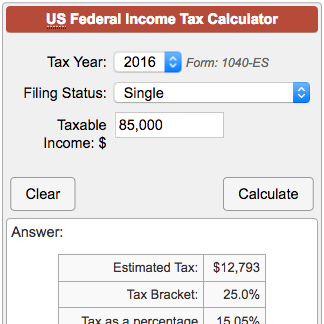

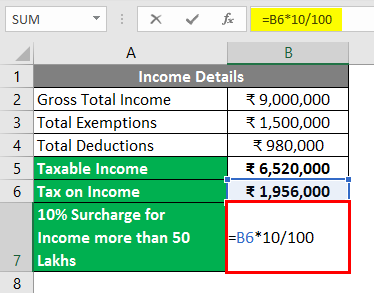

How To Calculate Income Tax In Excel

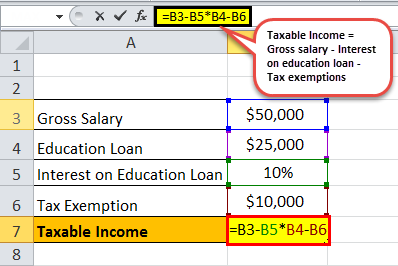

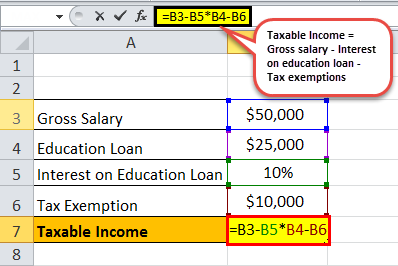

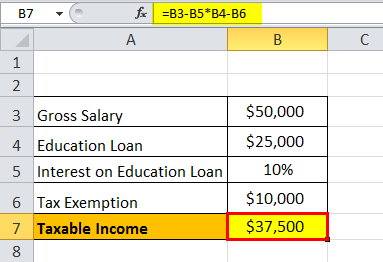

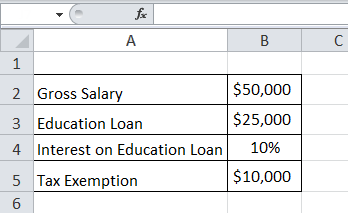

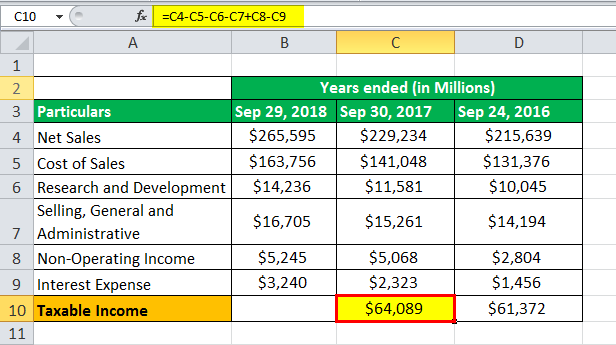

Taxable Income Formula Examples How To Calculate Taxable Income

Ontario Income Tax Calculator Wowa Ca

Taxable Income Formula Examples How To Calculate Taxable Income

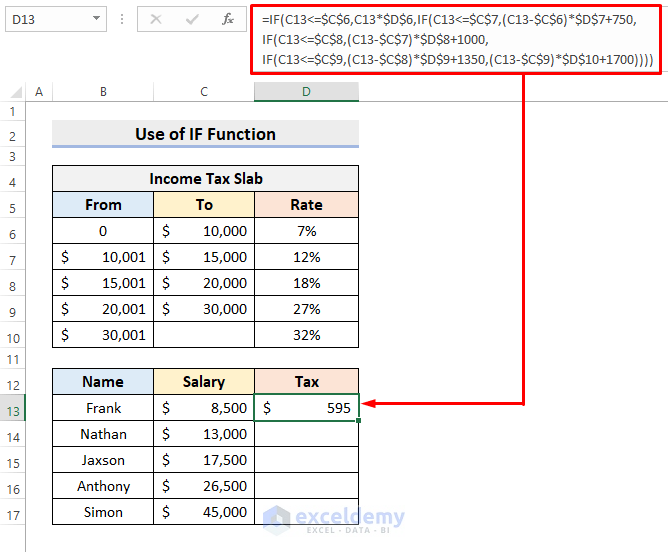

Excel Formula Income Tax Bracket Calculation Exceljet

Income Tax Calculating Formula In Excel Javatpoint

How To Create An Income Tax Calculator In Excel Youtube

Self Employed Tax Calculator Clearance 58 Off Www Wtashows Com

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Taxable Income Formula Examples How To Calculate Taxable Income

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

How To Calculate Income Tax In Excel Using If Function With Easy Steps

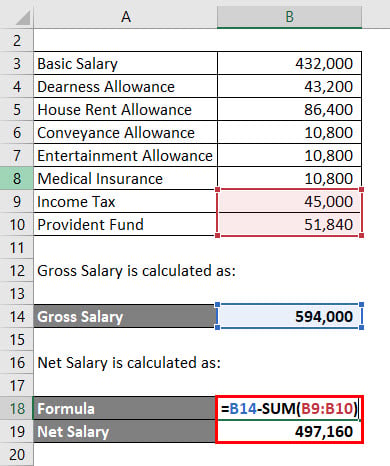

Salary Formula Calculate Salary Calculator Excel Template